All Categories

Featured

Table of Contents

The long-term care biker is a sort of sped up fatality benefit that can be used to spend for nursing-home, assisted-living, or at home care when the insured calls for assist with tasks of day-to-day living, such as showering, consuming, and making use of the commode. A assured insurability motorcyclist lets the insurance holder get additional insurance policy at a later date without a medical review. This opportunity can come with high costs and a reduced fatality advantage, so it might only be a good option for individuals who have maxed out other tax-advantaged financial savings and investment accounts. The pension plan maximization method explained earlier is an additional way life insurance policy can money retirement.

Insurance companies examine each life insurance policy candidate on a case-by-case basis. With thousands of insurers to pick from, practically anyone can locate an affordable policy that at the very least partly meets their demands. In 2023 there were greater than 900 life insurance policy and health companies in the United States, according to the Insurance Details Institute.

You require life insurance if you need to provide security for a spouse, youngsters, or other household members in case of your death. Life insurance survivor benefit can aid beneficiaries repay a home loan, cover college tuition, or assistance fund retired life. Permanent life insurance likewise includes a cash value component that constructs gradually.

Life insurance coverage death benefits are paid as a swelling sum and are exempt to federal income tax due to the fact that they are ruled out earnings for recipients. Dependents don't have to stress over living expenses - Term life. The majority of policy calculators recommend a multiple of your gross earnings equal to seven to 10 years that can cover significant costs such as mortgages and university tuition without the making it through partner or youngsters having to take out financings

What is Life Insurance Plans?

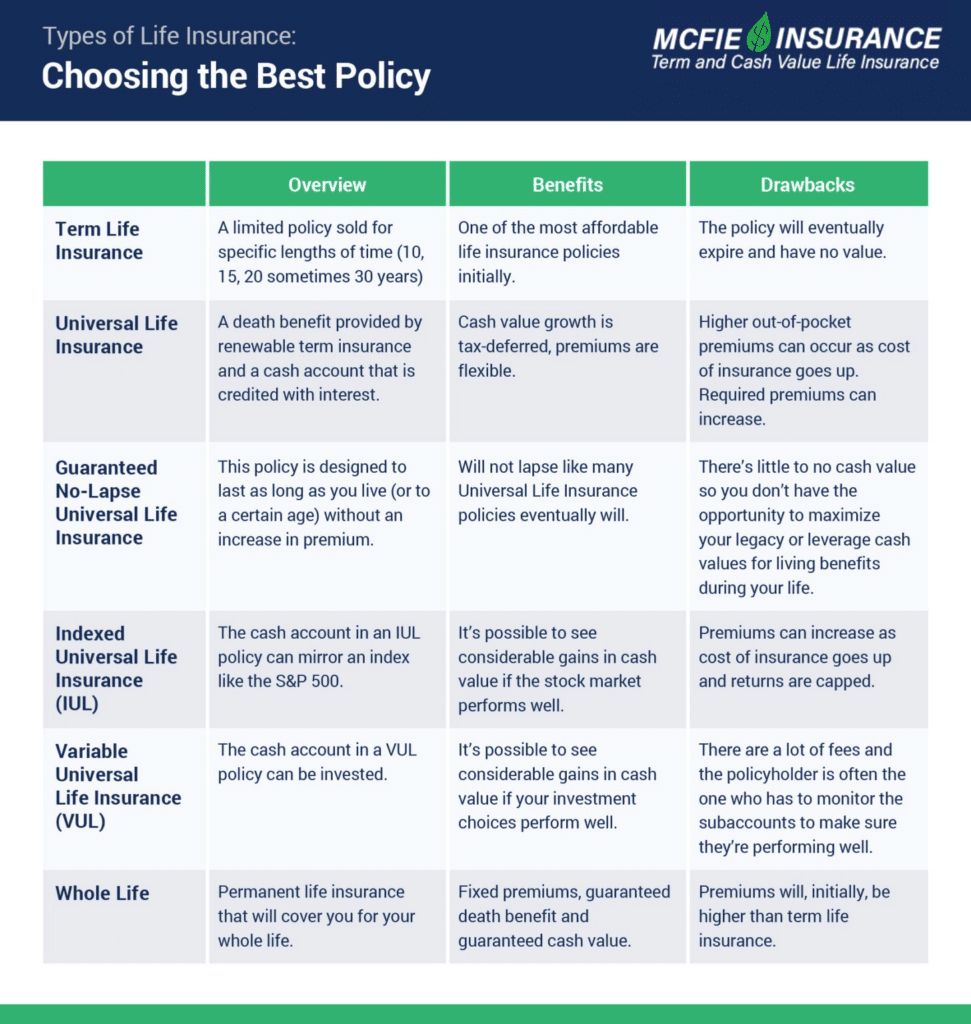

When you decide what type of insurance policy you need and how much insurance coverage makes sense for your situation, contrast products from top life insurance coverage companies to establish the very best fit.

Energetic worker has to be permanent (normal condition, 80% or higher) or part-time (regular condition, 40%-79%) - Income protection. If you choose reliant and/or spouse/qualifying adult coverage, you will certainly be needed to finish a Statement of Health and wellness. The Supplemental Life part of the plan offers extra protection for those who count on you economically

Advantage alternatives are readily available in numerous increments with the minimal advantage amount as $20,000 and the optimum benefit amount as $500,000. If you are presently enlisted in Supplemental Life, you might boost your insurance coverage by one degree without a Statement of Health and wellness. Any kind of additional level of protection will certainly require a Statement of Wellness.

No person may be guaranteed as a Dependent of more than one staff member. For your youngster to be eligible for protection, your youngster has to: Be 14 days to 1 year old for $500 or 1 years of age approximately 26 years for $10,000 (over 26 years may be proceeded if the Reliant Kid satisfies the Disabled Child needs) No person can be insured as a dependent of more than one staff member If you come to be terminally ill because of an injury or sickness, you or your legal agent have the option to ask for an ABO.

What is included in Legacy Planning coverage?

The taxed price of this team term life insurance policy is computed on the basis of consistent premium prices figured out by the Internal Earnings Service based on the worker's age. MetLife picked AXA Help USA, Inc. to be the administrator for Traveling Support services. This service aids interfere in medical emergency situations in foreign nations.

Nevertheless, you will certainly owe taxes if any kind of part of the quantity you withdraw is from interest, dividends or funding gains. Also understand that the amount you withdraw will certainly be deducted from the policy's survivor benefit if it's not repaid. You'll be charged interest if you obtain a funding versus your permanent life policy, but it's typically lower than the interest charged by other lenders.

What are the top Wealth Transfer Plans providers in my area?

It's a useful living advantage to have when you consider that 70 percent of people transforming 65 today will certainly require some kind of long-lasting treatment in their lives.

Right here's how: is a type of irreversible life insurance (as is global and variable life). Irreversible life insurance coverage plans will enable you to gain access to of your account while you're to life.

And you won't have prompt access to money once the policy goes online. You'll require a sufficient money amount in the account before you can use it (and it takes some time to develop that up).Get a cost-free cost quote currently. Assuming you have a policy that has a cash money element to it, you might after that surrender it and withdraw the whole present cash value.

It's a preferred that you can't utilize your life insurance while active. Not only can you possibly utilize it, but it might likewise be a far better lorry than other kinds of credit rating.

How do I cancel Term Life?

If you're interested in the advantages this choice can manage then begin by obtaining a complimentary rate quote. Matt Richardson is the managing editor for the Managing Your Money section for He creates and modifies material concerning individual money ranging from financial savings to spending to insurance coverage.

Life Insurance coverage with living benefit riders gives economic defense throughout considerable life occasions or health issues. These bikers can be included to permanent and term life insurance coverage policies, yet the terms differ.

At its core, life insurance policy is developed to give economic security to your enjoyed ones in the event of your death. As the requirements and needs of customers have developed, so have life insurance coverage items.

Latest Posts

Insurance Policy To Pay For Funeral

Term Life Insurance Quotes Instant

Funeral Cost Cover