All Categories

Featured

Table of Contents

Adolescent insurance coverage supplies a minimum of protection and could provide protection, which could not be readily available at a later date. Amounts given under such protection are usually restricted based upon the age of the kid. The existing restrictions for minors under the age of 14.5 would certainly be the better of $50,000 or 50% of the amount of life insurance policy active upon the life of the applicant.

Juvenile insurance may be offered with a payor benefit biker, which attends to waiving future costs on the youngster's plan in case of the fatality of the individual who pays the costs. Senior life insurance policy, often referred to as graded fatality benefit strategies, offers eligible older applicants with very little whole life insurance coverage without a medical exam.

The allowable concern ages for this kind of insurance coverage range from ages 50 75. The maximum problem quantity of protection is $25,000. These plans are usually more expensive than a totally underwritten policy if the individual qualifies as a typical risk. This sort of coverage is for a tiny face amount, usually bought to pay the burial expenditures of the insured.

Our term life alternatives consist of 10, 15, 20, 25, 30, 35, and 40-year policies. One of the most prominent type is level term, meaning your settlement (costs) and payment (fatality advantage) stays level, or the exact same, up until completion of the term period. This is one of the most uncomplicated of life insurance coverage alternatives and calls for extremely little maintenance for plan owners.

What are the top Level Term Life Insurance Companies providers in my area?

For instance, you could offer 50% to your partner and split the rest among your grown-up children, a parent, a good friend, and even a charity. * In some circumstances the death advantage may not be tax-free, learn when life insurance policy is taxable

1Term life insurance supplies temporary security for a crucial period of time and is typically cheaper than long-term life insurance policy. 2Term conversion standards and restrictions, such as timing, might apply; for instance, there may be a ten-year conversion opportunity for some items and a five-year conversion privilege for others.

3Rider Insured's Paid-Up Insurance Acquisition Alternative in New York. There is a cost to exercise this biker. Not all getting involved policy owners are qualified for rewards.

Level Term Life Insurance Coverage

We might be compensated if you click this ad. Advertisement Degree term life insurance coverage is a policy that gives the exact same survivor benefit at any kind of point in the term. Whether you die on the very same day you get a policy or the last, your beneficiaries will certainly get the very same payout.

Plans can also last till defined ages, which in a lot of instances are 65. Past this surface-level information, having a greater understanding of what these plans require will certainly aid ensure you acquire a plan that fulfills your needs.

Be mindful that the term you choose will affect the premiums you pay for the policy. A 10-year degree term life insurance policy policy will certainly set you back less than a 30-year plan due to the fact that there's less chance of an incident while the strategy is energetic. Lower threat for the insurance firm equates to reduce premiums for the policyholder.

Is there a budget-friendly Best Level Term Life Insurance option?

Your household's age should also affect your plan term selection. If you have kids, a longer term makes good sense due to the fact that it protects them for a longer time. Nonetheless, if your kids are near adulthood and will certainly be economically independent in the near future, a shorter term could be a far better suitable for you than an extensive one.

When contrasting whole life insurance policy vs. term life insurance policy, it deserves noting that the last generally costs much less than the former. The outcome is a lot more coverage with lower costs, offering the very best of both worlds if you need a substantial amount of insurance coverage however can not pay for a much more expensive policy.

Is Best Level Term Life Insurance worth it?

A level death benefit for a term policy generally pays out as a round figure. When that occurs, your heirs will certainly obtain the entire quantity in a solitary repayment, which quantity is ruled out earnings by the internal revenue service. Those life insurance policy earnings aren't taxable. Fixed rate term life insurance. Some degree term life insurance policy firms enable fixed-period repayments.

Rate of interest payments got from life insurance policies are taken into consideration income and are subject to tax. When your degree term life policy expires, a couple of different things can take place.

The downside is that your renewable degree term life insurance policy will include greater premiums after its first expiration. Advertisements by Cash. We might be compensated if you click this ad. Advertisement For beginners, life insurance policy can be made complex and you'll have concerns you want addressed prior to dedicating to any type of plan.

Who offers Affordable Level Term Life Insurance?

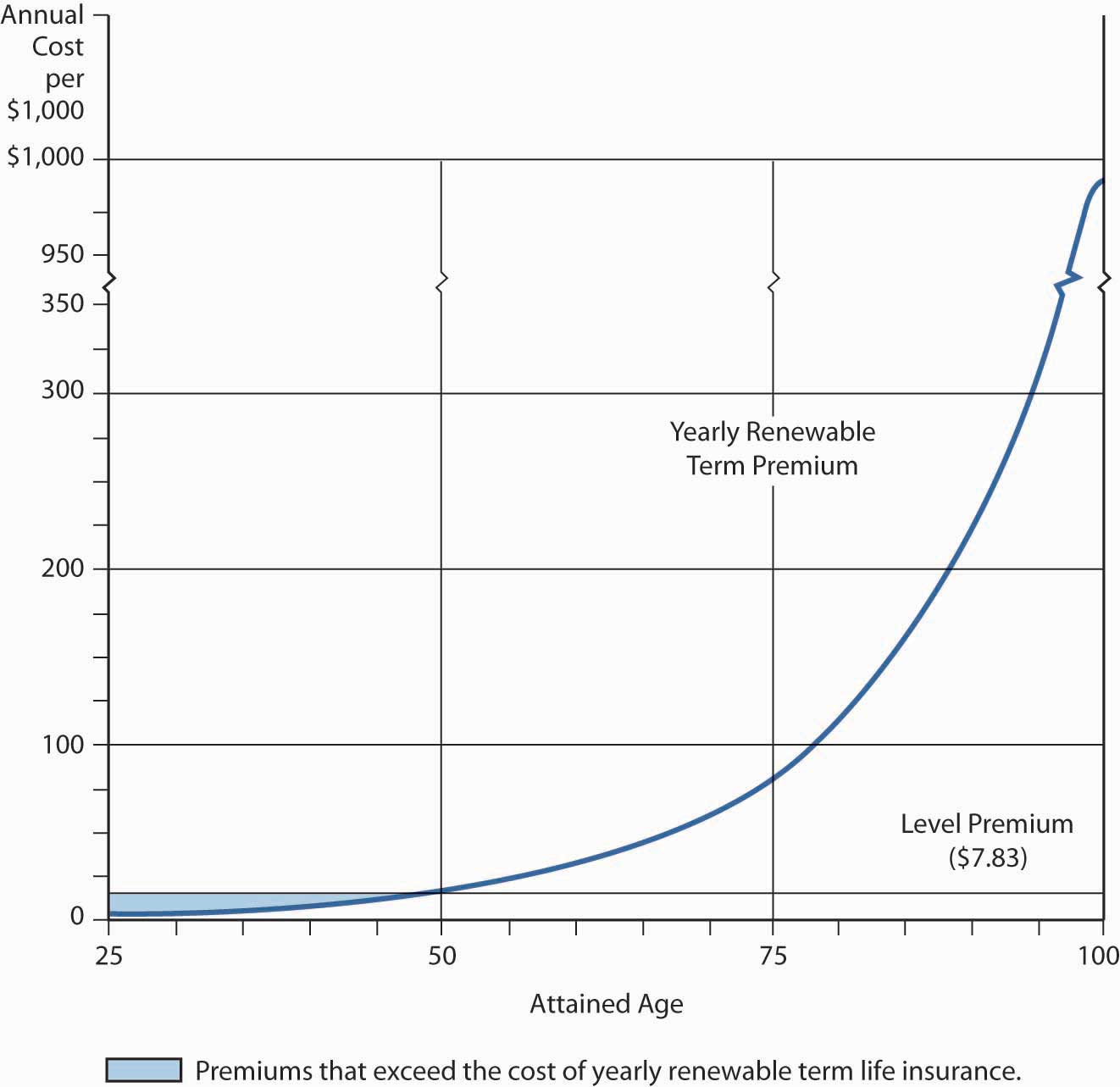

Life insurance policy companies have a formula for calculating danger utilizing mortality and rate of interest. Insurers have thousands of clients taking out term life policies simultaneously and utilize the premiums from its active plans to pay making it through beneficiaries of various other plans. These business use death tables to approximate the number of people within a certain team will certainly submit fatality claims each year, and that info is made use of to determine typical life expectancies for prospective policyholders.

Additionally, insurance companies can spend the cash they obtain from premiums and enhance their earnings. The insurance firm can spend the cash and earn returns - Best value level term life insurance.

The complying with area information the benefits and drawbacks of level term life insurance policy. Foreseeable premiums and life insurance policy protection Simplified plan structure Possible for conversion to long-term life insurance policy Minimal coverage duration No cash worth accumulation Life insurance policy costs can enhance after the term You'll find clear benefits when contrasting degree term life insurance to various other insurance coverage kinds.

Who are the cheapest Best Value Level Term Life Insurance providers?

You always understand what to expect with affordable level term life insurance protection. From the moment you take out a policy, your costs will certainly never ever transform, aiding you prepare financially. Your protection will not differ either, making these plans reliable for estate planning. If you value predictability of your payments and the payments your heirs will certainly receive, this type of insurance can be an excellent fit for you.

If you go this path, your costs will boost however it's always good to have some flexibility if you want to keep an energetic life insurance coverage plan. Eco-friendly degree term life insurance coverage is an additional alternative worth thinking about. These plans permit you to maintain your present plan after expiration, offering flexibility in the future.

Latest Posts

Insurance Policy To Pay For Funeral

Term Life Insurance Quotes Instant

Funeral Cost Cover