All Categories

Featured

Table of Contents

Maintaining all of these phrases and insurance types straight can be a frustration. The following table positions them side-by-side so you can quickly differentiate among them if you get puzzled. An additional insurance policy coverage type that can settle your mortgage if you pass away is a standard life insurance policy

A is in location for an established number of years, such as 10, 20 or 30 years, and pays your recipients if you were to pass away during that term. A supplies insurance coverage for your entire life period and pays out when you pass away.

One common guideline is to intend for a life insurance policy plan that will certainly pay out approximately ten times the policyholder's salary quantity. Additionally, you might pick to utilize something like the penny approach, which includes a family members's financial debt, earnings, mortgage and education and learning expenses to compute just how much life insurance policy is required (what is mortgage insurance).

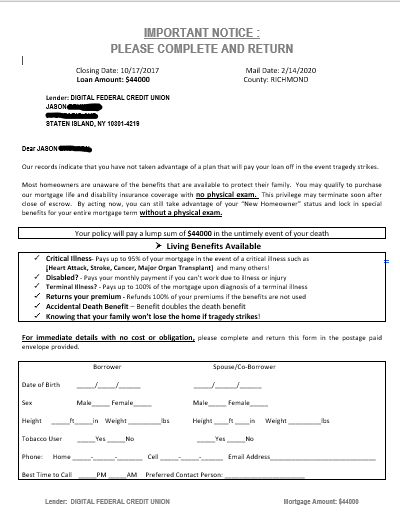

There's a factor new home owners' mail boxes are typically pestered with "Last Chance!" and "Urgent! Activity Needed!" letters from mortgage protection insurance providers: Numerous only enable you to buy MPI within 24 months of shutting on your mortgage. It's additionally worth noting that there are age-related limitations and limits enforced by almost all insurers, who often will not provide older purchasers as many choices, will bill them much more or may refute them outright.

:max_bytes(150000):strip_icc()/insurance_final-636cb6bc31de489f836f16f029289faf.jpg)

Below's how home loan security insurance determines up against common life insurance policy. If you have the ability to receive term life insurance, you need to prevent mortgage defense insurance coverage (MPI). Contrasted to MPI, life insurance policy offers your family a cheaper and extra adaptable advantage that you can trust. It'll pay out the same quantity anytime in the term a death happens, and the cash can be utilized to cover any expenses your family members considers essential at that time.

In those scenarios, MPI can give great tranquility of mind. Every home loan security choice will have numerous guidelines, policies, advantage options and drawbacks that require to be considered carefully against your precise scenario.

Home Insurance And Life Insurance

A life insurance policy policy can assist settle your home's home mortgage if you were to pass away. It is among many manner ins which life insurance policy might help safeguard your liked ones and their monetary future. Among the ideal ways to factor your home loan into your life insurance coverage need is to speak with your insurance policy representative.

Rather than a one-size-fits-all life insurance policy plan, American Family Life Insurer uses plans that can be designed specifically to meet your household's requirements. Here are some of your choices: A term life insurance policy plan. insurance that pays house in case of death is active for a certain quantity of time and generally offers a larger quantity of insurance coverage at a lower rate than an irreversible plan

Rather than just covering an established number of years, it can cover you for your entire life. It also has living advantages, such as cash money value buildup. * American Family Members Life Insurance policy Company supplies different life insurance policies.

Your representative is a great resource to address your concerns. They might also be able to assist you find gaps in your life insurance policy protection or new methods to reduce your various other insurance coverage. ***Yes. A life insurance coverage recipient can pick to use the survivor benefit for anything - using life insurance as collateral for mortgage. It's a terrific means to assist guard the economic future of your family members if you were to die.

Life insurance policy is one method of aiding your family members in paying off a home loan if you were to pass away prior to the mortgage is entirely repaid. No. Life insurance coverage is not required, but it can be a crucial part of helping see to it your liked ones are economically safeguarded. Life insurance policy proceeds may be utilized to assist settle a mortgage, but it is not the exact same as home loan insurance policy that you may be needed to have as a problem of a lending.

Using Life Insurance To Pay Off Mortgage

Life insurance policy may aid guarantee your home remains in your family members by offering a death benefit that might assist pay down a home mortgage or make important acquisitions if you were to pass away. This is a quick description of insurance coverage and is subject to plan and/or motorcyclist terms and problems, which might differ by state.

Words life time, lifelong and permanent go through plan terms and conditions. * Any type of financings drawn from your life insurance policy policy will build up interest. why do you pay mortgage insurance. Any type of outstanding financing equilibrium (lending plus rate of interest) will certainly be subtracted from the survivor benefit at the time of case or from the money value at the time of surrender

** Based on policy terms. ***Price cuts may vary by state and firm underwriting the vehicle or homeowners plan. Discount rates may not use to all protections on an auto or home owners policy. Discount rates do not relate to the life policy. Plan Forms: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

Home mortgage defense insurance coverage (MPI) is a various kind of secure that can be useful if you're incapable to settle your home loan. Home loan security insurance coverage is an insurance coverage plan that pays off the remainder of your home loan if you pass away or if you end up being impaired and can't function.

Both PMI and MIP are required insurance protections. The amount you'll pay for home mortgage defense insurance depends on a variety of variables, consisting of the insurance provider and the existing equilibrium of your mortgage.

Still, there are pros and disadvantages: Many MPI plans are provided on a "assured approval" basis. That can be helpful if you have a wellness problem and pay high prices forever insurance or battle to acquire insurance coverage. is it mandatory to have life insurance with a mortgage. An MPI policy can supply you and your family with a sense of security

Mortgage Plan Protection

You can select whether you require home mortgage protection insurance and for just how long you require it. You could desire your home mortgage security insurance term to be close in length to how long you have actually left to pay off your mortgage You can cancel a home mortgage security insurance coverage policy.

Latest Posts

Insurance Policy To Pay For Funeral

Term Life Insurance Quotes Instant

Funeral Cost Cover